Income Tax With E-Filing Advanced Training Through Live/Online

LAST DATE OF REGISTRATION2/12/2026

CLASSES COMMENCING FROM 2/15/2026

Course Description:

As generally speaking that an income tax is a tax imposed on individuals or entities that vary with the income or profits (taxable income) of the taxpayer. The Details vary widely by the jurisdiction of Pakistan. Many jurisdictions refer to income tax on business entities as a companys tax or corporate tax. Partnerships generally are not taxed; rather, the partners are taxed on their share of partnership items. Tax may be imposed by both a country and subdivisions. Most jurisdictions exempt locally organized charitable organizations from tax.

Income tax generally is computed as the product of tax slabs of taxable income. The tax rate may increase as taxable income increases according to the defined by Federal Board of Revenue (FBR) Pakistan. These Taxation rates may vary by type or characteristics of the taxpayer. Capital gains may be taxed at different rates than other income. Credits of various sorts may be allowed that reduce tax. Some jurisdictions impose the higher of an income tax or a tax on an alternative base or measure of income.

In Pakistan, tax culture was introduced initially, but most of the individuals and companies do not know very properly that how to submit tax according to the Law. And finally, they have done mistakes in the submission of income taxes and when FBR introduces online taxation system through electronically via their official website. From then it becomes more difficult to understand by the ordinary persons or accountants. Therefore, we have developed one of the required training programs which are most desirable according to the market, individual and companies. The program covers Income Tax and E-Filing Submission.

MAIN CAMPUS KARACHI

Suite # 7, Noble Heights, Opposite Askari Park Main University Road Karachi, PakistanPECHS CAMPUS KARACHI

A 223 Block-2 P.E.C.H.S. Near Artes school behind Baharia Town Tower, Main Tariq Road Karachi.Course Glimpse

- Trainer's Profile

-

Trainer's & Consultants

Mr. Javed Mushtaq

MBA, MA Economics, CA, CIMA

Director Finance

Professional Trainer

Over 25 Years of Professional Experience in the field of Accounts and Taxation. He has enormous experience in Management Accountancy, Financial Accounting, and Financial Management, with Income and Sales Tax handing on large scales, and its related Solutions. Further, he has extensive experience and knowledge of Management Accountancy and Financial Accounting and has served various organizations as a financial management consultant. Right now he is engaged with one of the renowned companies as Director Finance and controlling financial management, and financial management areas. He has also been engaged with 3D EDUCATORS for the last fifteen years, where has trained several candidates and proved his worth and demand. His training methodology is dynamic & lively and due to his versatile experience & exposure, he has excellent feedback from the students and professionals. During his journey with 3D EDUCATORS, he has conducted 100s of sessions of Advance Excel, CMA, Financial accounting, Tax, and financial modeling - PRE-REQUISITE

-

Pre-Qualifications of the Program

The person must have the basic knowledge of accounting and able to understand the taxation and its requirement, where he/She can adopt the importance of tax law and its implication and Implementation. - WHO CAN ATTEND

-

Concerned People Who can take Program

The Program will be suitable for professionals and who would like to enhance their skills in the area of Income Tax. After this Income Tax training the candidate may able to work in the professional environment and able to work on Income Tax. - SCOPE & JOB MARKET

-

Job Oriented Course

In early decades of 20th century, to get the Job in open market is not the problem and every person after their graduation may have got the job in very easiest way. But in the 21st Century, it is a big task to first get the Job and after getting the job,it is more difficult to retain and upgrade your jobs. Now there is only one solution to retain and get the jobs in the professional market is to have the international certifications. 3D Educators is one of the training and development company that helps to develop and enhance your career and to provide the opportunity to train & update yourself according to market and its requirement. - TRAINING & CERTIFICATION

-

Accreditation from

We at 3D EDUCATORS is adopted the methodology of training with the international criteria. In this training program you can have the complete knowledge and skills regarding the above mentioned program. After the training, you are sound and capable to start the working in the same field. Further your certification will be endorsed you as a candidate and increase your worth in the market. - INTERNATIONAL RECOGNITION AND ACCREDITATION

-

Market Demand

As mentioned above the certifications are most important part now in the professional world. Especially in the field of Taxation, you cannot survive, if you don't have got the International Credentials with you. All big organizations Offer the different Certifications that accredited you in the professional world. - EARLY BIRD DISCOUNT

-

Early Bird Discount Date

Discount Available on Membership Only - DAY AND TIME OF CLASS

-

Day & Time of the Class

Sunday 4:00pm - 7:00pm - COURSE FEE IN PAKISTAN

-

Total Fee Package

Please Note

PAK Rupees: - FEE FOR INTERNATIONAL STUDENTS

-

Total Fee Package

Please Note

USD:

Contact for Details & Admission:

Pakistan Main Campus:

Suite # 7, Mezzanine Floor, Noble Heights, KDA Scheme # 7, Opposite Sales Tax House/Askari Park, Main University Road Karachi. Contact at : 9221-34857148, 9221-34141329, 0333-2402474

PECHS Karachi Campus:

A 223 Block-2 P.E.C.H.S. Near Artes school behind Bahria Town Tower, Main Tariq Road Karachi.Google Map: https://maps.app.goo.gl/tDwBiSpZsvqQuUWh8

Contact at : 02134141329 | 03122811963 | 03332402474

IMPORTANT NOTE:

Please note if you are submitting fee ONLINE, and not transferring in our Bank Account which is mentioned in the Admission Form, then follow the instructions of those emails only, which comes from the official email address i-e: 3deducators@gmail.com.

Please do not send any amount to any other person without any email from above mentioned email address i-e:3deducators@gmail.com. This email gives you the complete details and guidelines that where and to whom submit the amount regarding fee.

Thanks and Regards MANAGEMENT 3D EDUCATORSThanks and Regards

MANAGEMENT 3D EDUCATORS

Students Google Reviews

Do You Want Enroll in...

147th Batch StartingBook Your Course and Save Admission Fee

Query Form

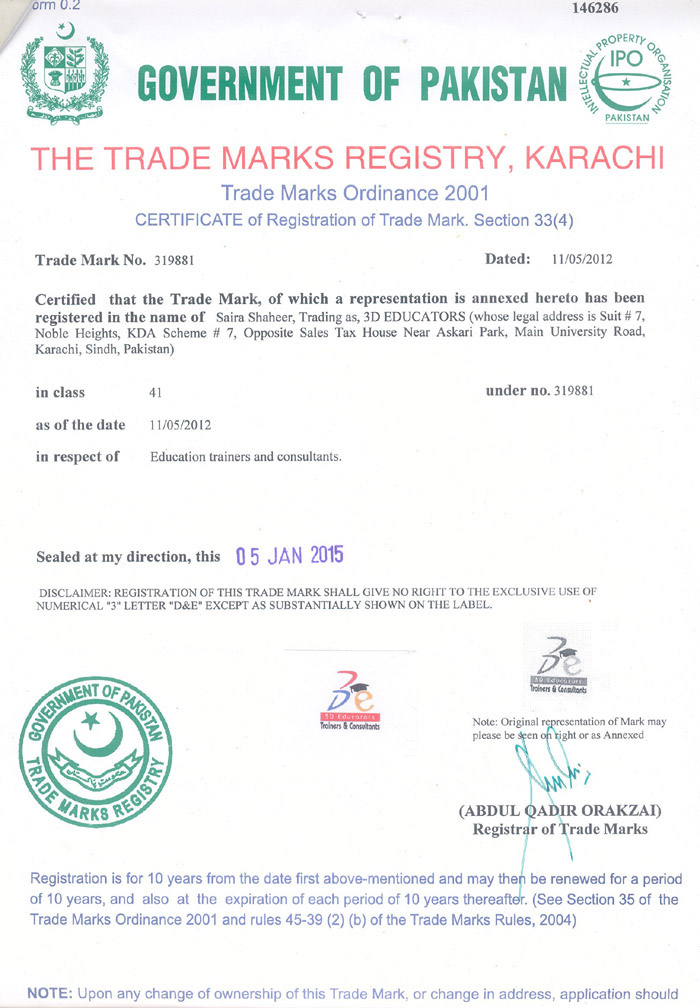

TRADEMARK REGISTRATION FROM GOVERNMENT OF PAKISTAN

Our Digital Campuses & Affiliate Partners